Track access charges are one of the key cost drivers in rail freight transport. They determine whether trains can operate economically – or whether transport services disappear from the market and are forced back onto the roads.

What is currently emerging is not a normal price development, but a structural cost problem: track access charges are rising sharply, while track access subsidy is losing its dampening effect. This is putting combined transport under enormous pressure.

For years, track access charging (TraFöG) was able to cushion some of the rising infrastructure charges. This logic no longer applies today.

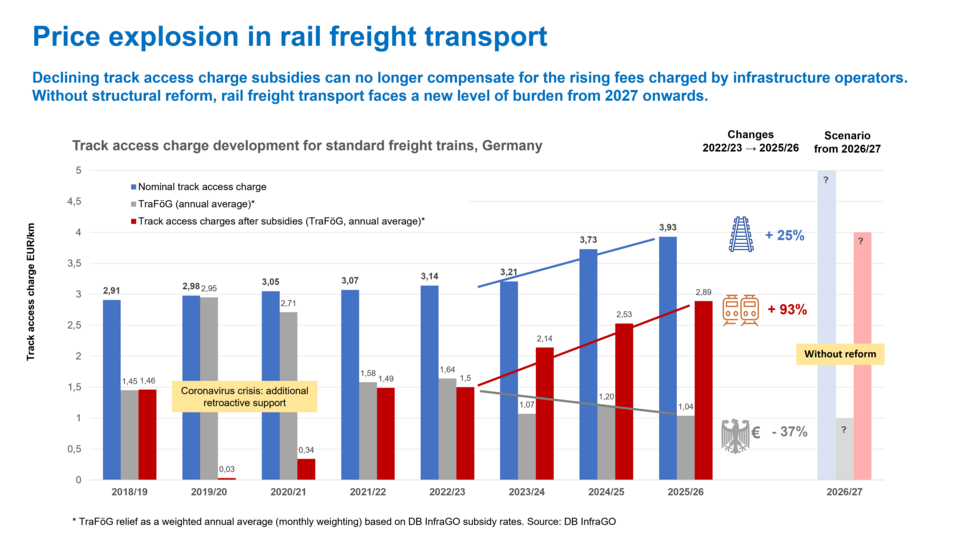

The graph showing the development of track access charges in rail freight transport clearly illustrates this:

Since 2022, track access charges per train kilometer have been rising significantly.

At the same time, track access subsidy fluctuates greatly, depending on budgetary resources and forecasts.

The net effect for rail transport companies is clear: effective track access costs are rising massively.

The period from 2022/23 to 2025/26 is particularly striking: while DB InfraGO's track access charges will increase many times over during this period, subsidies will only be able to partially compensate for this increase – and not reliably so. Temporary special effects, such as retroactive additional subsidies during the coronavirus crisis, are coming to an end and no longer mask the structural development.

The bottom line is that the industry is now paying significantly more per train kilometer traveled – despite subsidies. At the same time, a further significant increase in fees is on the horizon for the coming years as soon as special effects and budget cuts expire. Without structural reform, a new wave of costs threatens from 2027 onwards – with noticeable effects on profitability and service provision.

To put it plainly:

track access subsidy is losing its stabilizing effect. Cost pressure is hitting combined transport directly.

This development would be critical in itself. However, it is exacerbated by the conditions on the network:

- massive corridor closures

- reduced capacities

- unstable timetables

- increasing operational risks

Combined transport is therefore paying higher prices for poorer performance. This is not only economically problematic—it is also counterproductive in terms of transport policy.

To put it plainly:

higher costs and lower reliability weaken the competitive position of rail compared to road transport.

Another core problem is the lack of predictability:

- Track access charges are set very late.

- Subsidy levels remain unclear for a long time.

- Customer prices must nevertheless be calculated early on.

For combined transport operators, this means that they bear the full price and forecast risk—with extremely tight margins.

To put it plainly:

a transport system that demands planning security but offers none is not marketable.

The current track access charge logic further exacerbates the imbalance:

- Rail freight transport bears a disproportionate share of infrastructure costs.

- Market viability logic means that successful segments in particular are subject to higher charges.

- Passenger transport is politically stabilized - freight transport is not.

To put it plainly:

climate-friendly freight transport is becoming a financing reserve in the system.

The development of track access charges is not a technical detail – it is a matter of survival for combined transport. The graph clearly shows:

- Track access charges are rising sharply.

- Subsidies are volatile and insufficient.

- The cost gap is growing.

- The economic basis of the system is eroding.

If the currently foreseeable cost developments materialize, rail freight transport will face a new wave of costs from 2027 onwards – with noticeable effects on profitability, supply, and willingness to invest.

If this development is not stopped, there is a risk of supply reductions, a shift of traffic to the roads, and lasting damage to logistics, industry, and climate targets.

- Effective limitation of track access charges in rail freight transport

- Reliable, stable track access subsidy that compensates for price increases in real terms

- Early and predictable determination of charges and subsidy rates

- Reform of track access pricing logic: infrastructure as a public service

- Fair cost distribution between passenger and freight transport